So, you’ve got your trip all planned out and you’re super excited to finally escape the daily grind and explore new horizons. But wait, you suddenly find yourself wondering, “Is travel insurance mandatory for my trip?” It’s a valid question, and one that many travelers ask themselves. We all know that unexpected situations can arise while traveling, and having travel insurance can provide that extra peace of mind. But is it really necessary? Let’s dig a little deeper to find out.

What is travel insurance?

Travel insurance is a type of insurance that provides coverage and protection for travelers in case of unforeseen events, such as medical emergencies, trip cancellations or interruptions, and loss or damage to personal belongings. It is designed to provide financial assistance and peace of mind to travelers, helping them navigate unexpected situations while they are away from home. Travel insurance policies vary in terms of coverage and benefits, allowing travelers to choose the level of protection that suits their needs and travel plans.

Understanding the purpose of travel insurance

Protecting against unforeseen events

One of the primary purposes of travel insurance is to protect travelers against unforeseen events that may occur during their trip. This can include accidents, illnesses, or even natural disasters that may disrupt travel plans. With travel insurance, you can be covered for unforeseen events that may require emergency medical treatment, repatriation, or even evacuation.

Covering medical expenses

Another important aspect of travel insurance is its ability to cover medical expenses incurred during a trip. It provides financial protection to cover costs such as doctor visits, hospital stays, medications, and emergency medical transportation. This is particularly crucial when traveling to countries with expensive healthcare systems or inadequate medical facilities.

Compensation for trip cancellation or interruption

Travel plans can sometimes be disrupted due to unexpected circumstances, such as a sudden illness, family emergency, or natural disaster. In such cases, travel insurance can provide compensation for trip cancellations or interruptions, including reimbursement for non-refundable expenses such as flights, accommodations, and prepaid activities. This ensures that you are not left out of pocket if your trip needs to be cut short or canceled.

Ensuring financial assistance in case of emergencies

Travel insurance also serves as a financial safety net in case of emergencies. If you find yourself in a situation where you need immediate assistance, such as lost or stolen belongings, travel insurance can provide the necessary support to help you replace or recover your items. It can also offer assistance in case of legal issues or emergencies in a foreign country, providing you with the necessary resources and guidance to navigate through difficult circumstances.

Factors to consider before deciding on travel insurance

Before deciding on travel insurance, there are several factors that you should take into consideration to ensure that you choose the right coverage for your needs.

Destination and duration of the trip

The destination and duration of your trip play a crucial role in determining the type and level of coverage you may need. Different countries have varying healthcare systems and costs, so it is important to consider whether you would require a higher coverage limit in case of medical emergencies. Similarly, the length of your trip may impact the likelihood of trip cancellations or interruptions, so it is essential to choose a policy that adequately covers these risks.

Type of activities planned

If you are planning on engaging in any high-risk activities during your trip, such as adventure sports or extreme outdoor activities, it is important to ensure that your travel insurance policy covers these activities. Many standard policies have exclusions for high-risk activities, so it may be necessary to purchase additional coverage or a specialized policy that provides adequate protection.

Health conditions and age of the traveler

Your current health conditions and age may also influence the type of travel insurance policy you need. Some policies may have restrictions or exclusions for pre-existing medical conditions, so it is important to check the policy terms and conditions to ensure that you are adequately covered. Similarly, older travelers may require policies that offer higher coverage limits or age-specific benefits.

Value of belongings to be carried

If you are carrying valuable belongings, such as expensive electronic devices or jewelry, it is important to consider coverage for loss, theft, or damage to these items. Some travel insurance policies offer coverage for personal belongings, while others may only provide limited protection. It is important to assess the value of your belongings and choose a policy that offers appropriate coverage.

Legal requirements and regulations

When it comes to travel insurance, there may be certain legal requirements and regulations that you need to consider, depending on your destination.

International requirements

Some countries may have specific requirements for travel insurance, particularly for obtaining a visa or entry into the country. For example, certain Schengen countries in Europe require visitors to have travel insurance with a minimum coverage amount. It is important to research and understand any international requirements related to travel insurance to ensure compliance and avoid any complications during your trip.

Specific requirements for certain destinations

In addition to international requirements, certain destinations may have specific regulations or recommendations regarding travel insurance. For example, countries prone to natural disasters or political instability may strongly advise travelers to have comprehensive coverage that includes emergency evacuation. It is important to research and understand any destination-specific requirements to ensure that you choose the right travel insurance policy for your trip.

Travel insurance options

There are several travel insurance options available to travelers, each offering different types and levels of coverage. It is important to understand these options to choose the best policy that suits your needs.

Comprehensive travel insurance

Comprehensive travel insurance provides a wide range of coverage, including medical expenses, trip cancellations or interruptions, emergency evacuation, and loss or damage to personal belongings. It offers the most extensive protection and is suitable for travelers who want peace of mind and comprehensive coverage for their trip.

Medical or health insurance

Medical or health insurance policies specifically focus on covering medical expenses incurred during a trip. These policies are particularly important for travelers who are concerned about access to quality healthcare in their destination country.

Trip cancellation or interruption insurance

Trip cancellation or interruption insurance provides reimbursement for non-refundable expenses in case your trip needs to be canceled or cut short due to unexpected events such as illness, injury, or natural disasters. This type of coverage is particularly useful for travelers with expensive non-refundable bookings, such as flights or accommodations.

Baggage and personal belongings insurance

Baggage and personal belongings insurance provides coverage for loss, theft, or damage to personal belongings during a trip. This is especially important for travelers carrying valuable items or equipment.

Accidental death and dismemberment insurance

Accidental death and dismemberment insurance provides coverage in the event of accidental death or severe injury resulting in permanent disability. This type of coverage offers financial protection to travelers and their families in case of a tragic accident during the trip.

Assessing the need for travel insurance

Before deciding on whether or not to purchase travel insurance, it is important to assess the need based on various factors related to your trip.

Nature of the trip

Consider the nature of your trip and the potential risks involved. If you are embarking on a high-risk adventure trip or traveling to a destination with unreliable healthcare facilities, travel insurance is a must to ensure you are adequately protected.

Healthcare system in the destination country

Research and understand the quality and accessibility of healthcare in your destination country. If the healthcare system is expensive or not up to standards, having travel insurance with comprehensive medical coverage becomes crucial.

Financial ability to handle unexpected expenses

Consider your financial ability to handle unexpected expenses that may arise during the trip. Medical emergencies or trip cancellations can result in significant financial burdens, and travel insurance provides the necessary financial assistance to mitigate these risks.

Risk factors involved in the trip

Evaluate the risk factors involved in your trip, such as the likelihood of accidents, theft, or political instability. Travel insurance provides coverage for these risks, offering peace of mind and a safety net in case of unforeseen events.

Consequences of not having travel insurance

Choosing not to have travel insurance can have serious consequences, leaving you financially vulnerable and exposed to various risks during your trip.

Out-of-pocket expenses

Without travel insurance, you will be responsible for all expenses incurred during emergencies, including medical treatments, hospital stays, and emergency evacuation. These costs can be exorbitant and can quickly deplete your savings.

Difficulties in accessing appropriate medical care

Lack of travel insurance may lead to difficulties in accessing appropriate medical care in your destination country. This can result in delays in treatment or even inadequate medical care, putting your health and well-being at risk.

Complications in case of trip cancellation or interruption

If your trip needs to be canceled or interrupted due to unforeseen events, such as illness, family emergencies, or natural disasters, you will not be entitled to any refunds for non-refundable expenses. This can result in significant financial losses and impact future travel plans.

Legal issues in certain jurisdictions

Certain countries may have legal requirements or regulations that mandate travel insurance. Failure to comply with these requirements may result in legal issues, such as denied entry or even deportation. It is important to understand and adhere to any legal obligations related to travel insurance to avoid complications during your trip.

Exceptions and exclusions in travel insurance

While travel insurance provides valuable coverage, it is important to be aware of the exceptions and exclusions that may impact your policy coverage.

Pre-existing medical conditions

Many travel insurance policies have exclusions for pre-existing medical conditions, meaning that any medical treatments related to these conditions may not be covered. It is essential to disclose any pre-existing conditions and review the policy exclusions to understand the extent of coverage provided.

High-risk activities

Standard travel insurance policies often exclude coverage for high-risk activities, such as extreme sports or adventure activities. If you plan on engaging in such activities during your trip, it is important to ensure that your policy includes coverage for these activities or purchase additional coverage.

Acts of terrorism or war

Travel insurance policies may have exclusions for acts of terrorism or war. Depending on your travel destination and potential risks, it is important to understand the policy’s coverage regarding these events.

Unsupervised belongings

Travel insurance may not cover loss or damage to belongings that are left unattended or not properly secured. It is important to take necessary precautions to prevent theft or damage to your belongings and ensure compliance with the policy terms and conditions.

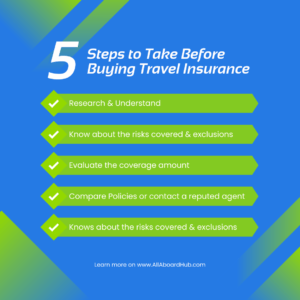

Factors to consider when purchasing travel insurance

When purchasing travel insurance, there are certain factors that you should consider to ensure you choose the right policy.

Coverage limits and exclusions

Review the coverage limits and exclusions of the policy to ensure that it aligns with your specific needs. Check for any restrictions or exclusions that may affect your coverage, especially related to medical expenses, trip cancellations, or high-risk activities.

Emergency assistance services

Consider the emergency assistance services provided by the insurer. Look for services such as 24/7 helplines, emergency medical evacuation, or access to a network of medical facilities to ensure appropriate assistance in case of emergencies.

Premium costs and deductibles

Compare the premium costs and deductibles of different insurance policies to find the one that offers the best value for your money. Keep in mind that cheaper policies may have higher deductibles or limited coverage, so it is important to strike a balance between premium costs and the level of coverage provided.

Terms and conditions of the policy

Carefully read and understand the terms and conditions of the policy before purchasing. Pay particular attention to any exclusions, limitations, or restrictions that may impact your coverage. If you have any questions or concerns, don’t hesitate to reach out to the insurer for clarification.

Conclusion

Travel insurance is an essential aspect of trip planning, providing financial protection and peace of mind during your travels. By understanding the purpose of travel insurance, assessing your needs, and considering the various options available, you can make an informed decision and choose the right policy for your trip. Remember to carefully review the terms and conditions, including any exclusions or exceptions, to ensure that you are adequately covered for potential risks and unforeseen events. So, before you embark on your next adventure, take the time to invest in travel insurance – it’s a small price to pay for the peace of mind it provides.